PERS Update: Fairy Dust in Investment Return Assumptions?

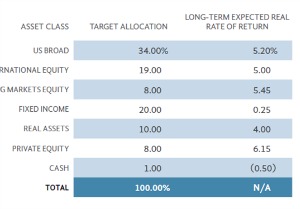

Let me get this straight. We expect our investment asset classes to earn around 5%, but when we put it all together it will magically earn 7.75%? Who’s in charge? Bernie Madoff?

Figure in expenses, commissions ($7.6 million last year alone) and what not and the investment assumption should be, what? 4.5%? That seems possible in the current economic climate.Of course, it could be worse over the next 10 years or so.

For the past year the actual investment return was 3.4%.

And check out page 7 of the separate PERS Projection_Report

On a 10 year annualized basis, PERS investment returns have not met the 8% investment return assumption in 10 years!

The reports should contain a disclaimer: “barring a miracle, this ain’t happening.”

PERS justifies its lofty investment assumption by pointing out that 25 year historical returns hit the number. But there’s a problem with that: the 1990’s.