Mississippi State Government & Agencies

BPF strives to inform citizens and elected officials on its views regarding public policies that benefit or cause hard to Mississippi's economic condition. Bigger Pie believes sound public policy grounded in fiscal responsibility is a cornerstone to successful communities.

Featured Work

MS Tax Freedom Act of 2022 Bill Proposes Reducing Grocery Tax and Cost of Car Tags

The Mississippi Tax Freedom Act of 2022, authored by House Speaker Philip Gunn, would eliminate the state’s personal income tax, but also would cut some other taxes as well in addition to increasing the state’s sales tax.

PERS’ Lessons from the Municipal Retirement Systems

Thirty five years after it was closed, MRS still covers 1,510 retirees in 19 cities.

Allocating Mississippi’s $1.8 Billion ARPA Funds

This upcoming legislative session promises to be a contentious but historic one as lawmakers allocate $1.8 billion in federal funds given to the state.

Tie PERS’ COLA to the Rate of Inflation

For decades, the COLA automatically increased as the U.S. dealt with historically low inflation. The solution for the Board of Trustees is simple: Tie PERS’ COLA to the rate of inflation as measured by the CPI.

Tax Report Contains Fabricated Numbers

As Mississippi Legislators work toward eliminating the personal income tax, they are looking for ways to recoup the resulting reduced revenue. One possible source is the elimination of various tax deductions, exemptions, and credits. But a Bigger Pie Forum (BPF) analysis has found that the Department of Revenue’s official estimates of these deductions, exemptions, and credits are largely fabricated and should not be relied upon by the state legislature.

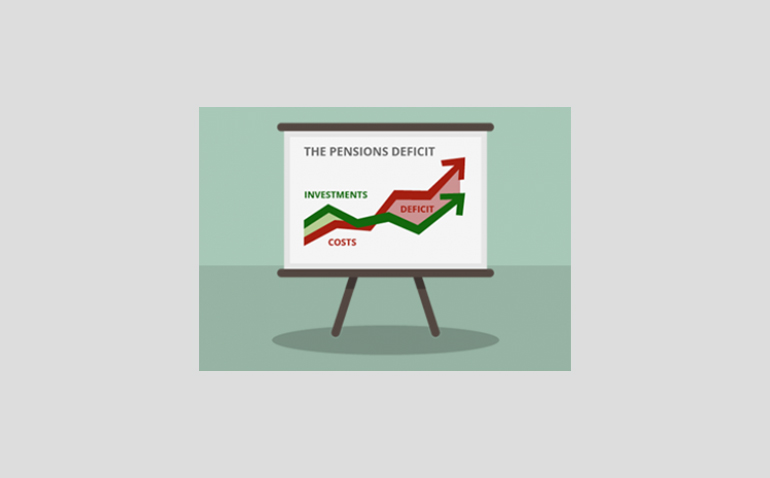

PERS Board Votes To Lower Expected Rate of Return

The board of trustees for the state’s Public Employees’ Retirement System (PERS) made an important, if unheralded, move recently when it voted unanimously to use a somewhat more realistic projection of its rate of return on investments. This matters because an overly optimistic projection can mask a coming decrease in the solvency of the fund, which is already severely under-capitalized.